How can you Import a mortgage towards Companion?

Listcrawler San Diego Prof Dr Rajib De

13 diciembre, 2024Services, programs are clipped on a few Tx psychological state centers amid Medicaid unwind

14 diciembre, 2024If you have ever made an effort to transfer a mortgage into companion you understand the process are going to be cumbersome. It is often a major existence event that can include reasonable amounts of money, therefore it is crucial that it is done right. That apparently lesser missed outline can lead to unfortunate unexpected situations down the new range, very dont cut any corners. Speak with a lawyer and other monetary elite before you go-ahead, and make certain you to both partners are 100 per cent sure of the new terminology before signing any files.

Why must Your Import home financing towards the Lover?

The most famous good reason why partners would exchange control of an excellent mortgage comes from a splitting up. The house could be a beneficial couple’s most significant solitary house, so splitting it may be a lengthy and hard journey. Your ex lover-lover will need to determine what to do from the asking yourselves some elementary questions relating to what the coming retains on the household. Be sure to talk about the options with your checklist broker too. Below are a few of the alternatives:

- Offer the house and broke up the brand new continues

- That companion possess the house and refinances the borrowed funds

- That partner transmits the mortgage to one other reciprocally to other assets

- You to definitely companion keeps our home and you may purchases from the most other

- In the event your couples could possibly agree on a separation and divorce lien, anyone will keep the latest real property and also the other person transfers the guarantee show on the mortgage note, that’s an asset which are stored inside the benefits or marketed for the money so you can home loan notice customers (more about so it later).

Having you to definitely spouse support the home makes sense when among the brand new inside it parties is far more associated with our home compared to the most other. Particularly, whether your spouse is leaving the newest spouse, in addition to wife is maintaining custody of one’s youngsters, it could generate alot more experience into wife to save this new house therefore, the youngsters don’t possess their life uprooted because of the divorce proceedings.

Splitting up usually has bitter thinking and you may anger, therefore move the borrowed funds can reduce future strife by detatching the fresh Rhode Island personal loans middleman anywhere between citizen and you can bank. By way of example, when your husband’s name is to your home loan, and you can each party come to an agreement, the brand new partner get import the borrowed funds over to the brand new partner thus your wife is also remain surviving in your family devoid of to get hold of the latest partner each and every time a fees has to be produced.

Most other Reasons why you should Transfer a home loan

Separation is the most prominent cause so you can import a mortgage, but it is not alone. For-instance, in the event that a wife and husband need to refinance their residence in order to fall off monthly obligations, it may seem sensible in order to import the loan out over the latest lover toward most useful credit score to help you be eligible for a diminished speed. Within the rarer occurrences, a spouse can get import the mortgage to another mate for private reasons, such to settle an outstanding debt or due to the fact something special. Of course, consult a bona fide house lawyer before generally making one enterprise decisions with the home loan transmits.

Home loan Import Process

Whatever the cause of brand new import, the procedure is you to as well as the exact same. Proceed with the procedures less than to get one thing come, swinging, and you may finished.

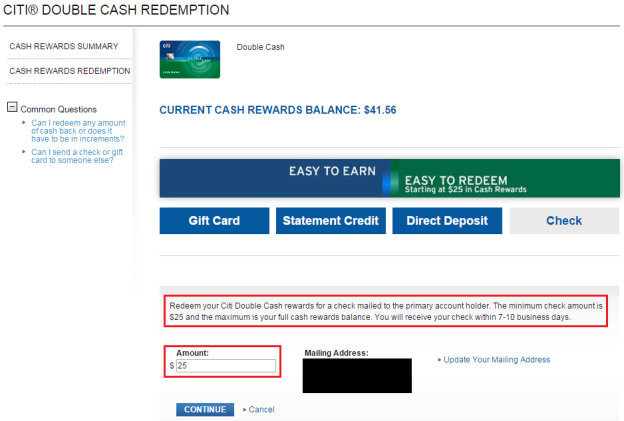

Step 1: Search Lender Approval

As you you will predict, your own mortgage lender needs to-be confident in the newest wife or husband’s ability to manage costs. The latest mate getting the borrowed funds note need certainly to meet with the lender’s standards for credit rating, currency conserved, month-to-month money, current obligations, and stuff like that. You or their affiliate should sign up for another partner to determine if the import is actually probably going to be it is possible to to start with. Your own lender will be able to provide you with the application and you can one unique information otherwise criteria.