Accounting Rate of Return Calculator ARR Calculator

Former Cerner and MEDITECH Healthcare IT Leader, Steve McDonald, Joins Pivot Point Consulting as Executive Partner

16 julio, 2021Blackouts Symptoms, Causes, Treatments

19 agosto, 2021

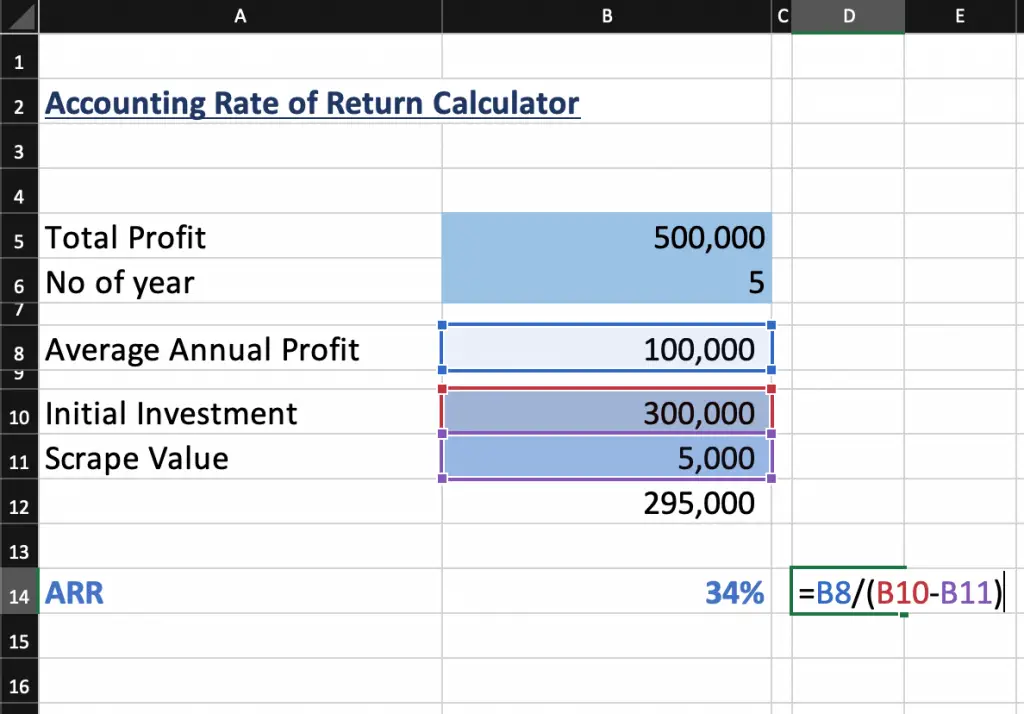

Based on this information, you are required to calculate the accounting rate of return. The Accounting Rate of Return (ARR) provides firms with a straight-forward way to evaluate an investment’s profitability over time. A firm understanding of ARR is critical for financial decision-makers as it demonstrates the potential return on investment and is instrumental in strategic planning.

Determine the initial investment cost

The project looks like it is worth pursuing, assuming that the projected revenues and costs are realistic. An example of an ARR calculation is shown below for a project with an investment of £2 million and a total profit of £1,350,000 over the five years of the project. So, in this example, for every pound that your company invests, it will receive a return of 20.71p.

How to Calculate Accounting Rate of Return?

Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value. The Accounting Rate of Return is also sometimes referred to as the «Internal Rate of Return» (IRR). AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. If so, it would be great if you could leave a rating below, it helps us to identify which tools and guides need additional support and/or resource, thank you.

FAQS on the Accounting Rate of Return

Generally, the higher the average rate of return, the more profitable it is. However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals. Like any other financial indicator, ARR has its advantages and disadvantages. Evaluating the pros and cons of ARR enables stakeholders to arrive at informed decisions about its acceptability in some investment circumstances and adjust their approach to analysis accordingly. It’s important to understand these differences for the value one is able to leverage out of ARR into financial analysis and decision-making. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period.

If the ARR is positive (equals or is more than the required rate of return) for a certain project it indicates profitability, if it’s less, you can reject a project for it may attract loss on investment. The Accounting rate of return is used by businesses to measure the return on a project in terms of income, where income is not equivalent to cash flow because of other factors used in the computation of cash flow. Calculating ARR or Accounting Rate of Return provides visibility of the interest you have actually earned on your investment; the higher the ARR the higher the profitability of a project. According to accounting rate of return method, the Fine Clothing Factory should purchases the machine because its estimated accounting rate of return is 17.14% which is greater than the management’s desired rate of return of 15%. An ARR of 10% for example means that the investment would generate an average of 10% annual accounting profit over the investment period based on the average investment. Business investment projects need to earn a satisfactory rate of return if they are to justify their allocation of scarce capital.

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one. Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000.

The ARR can be used by businesses to make decisions on their capital investments. It can help a business define if it has enough cash, loans or assets to keep the day to day operations going or to improve/add facilities to eventually become more profitable. ARR for projections will give you an idea of how well your project has done or is going to do. Calculating the accounting rate of return conventionally is a tiring task so using a calculator is preferred to manual estimation.

Of course, that doesn’t mean too much on its own, so here’s how to put that into practice and actually work out the profitability of your investments. HighRadius Autonomous Accounting Application consists of End-to-end Financial Close when to use a debit vs credit card Automation, AI-powered Anomaly Detection and Account Reconciliation, and Connected Workspaces. Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks.

- Business investment projects need to earn a satisfactory rate of return if they are to justify their allocation of scarce capital.

- HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth.

- Specialized staff would be required whose estimated wages would be $300,000 annually.

- EasyCalculation offers a simple tool for working out your ARR, although there are many different ARR calculators online to explore.

- However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project.

The Record-to-Report R2R solution not only provides enterprises with a sophisticated, AI-powered platform that improves efficiency and accuracy, but it also radically alters how they approach and execute their accounting operations. Accounting Rate of Return is a metric that estimates the expected rate of return on an asset or investment. Unlike the Internal Rate of Return (IRR) & Net Present Value (NPV), ARR does not consider the concept of time value of money and provides a simple yet meaningful estimate of profitability based on accounting data.

The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project that compensates them for a given level of risk. It is calculated using the dividend discount model, which accounts for stock price changes, or the capital asset pricing model, which compares returns to the market. The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment. Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project. It is a useful tool for evaluating financial performance, as well as personal finance.